September 2012 CD Rate Update

September 20th, 2012

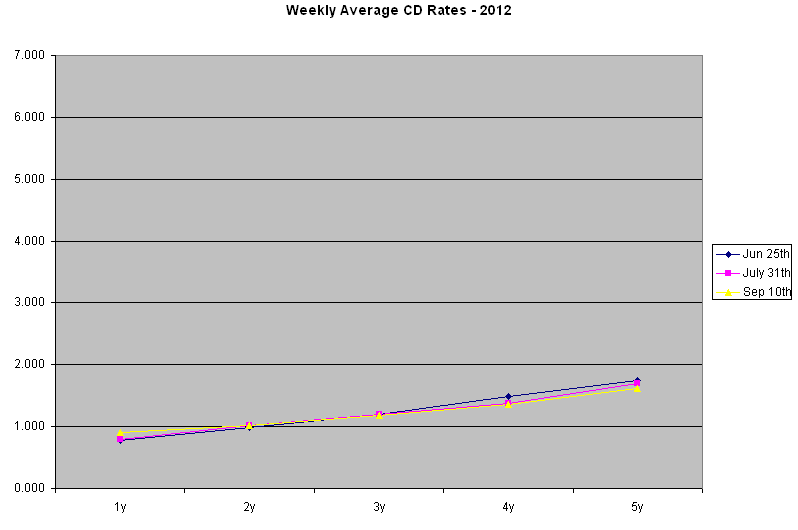

Below is an updated graph of the average weekly retail CD Rates since July 13. Sorry, I have skipped a couple of weeks, but the graph does have some interesting data points. I survey the top 30 banks and credit unions that are available in the national market.

1-Year CD Rates have Risen

The first thing you’ll notice is that the average 1-year CD Rates have risen. This week their are seven banks with a 1-year rate above 1.00% and because of the competition the high rate has edged up to 1.10%. In July it was 1.05%. Sadly, there are no credit unions in that top seven. Come on credit unions, you are supposed to have better rates. All but one of them is over $1 Billion in assets, but all are less than $10 Billion. The Mega Banks are not yet even close to having to compete for deposits.

Competition probably a better friend then the Fed

The Fed has stated they will be keeping Fed Funds at 0.00% to 0.25% until later in 2015. This means the government is going to continue to tell savers to take it in the shorts. However, as more and more people move their money out of banks searching for higher yields in alternative investments, banks will have to pay a higher rate to attract or keep your deposits. Specials may come and go quickly so keep your eyes peeled and hopefully you will have some funds available to take advantage.

Scale is important

On some previous graphs, I let Excel auto-scale, which gave a max rate of 2.00%. This gives the impression of rates looking better than they truly are. I’ve seen the same thing on graphs for stock returns and various indexes. You can scale something so that small increases look bigger than they are and large decreases look smaller. So consider the scale when you are looking at any graph. In the future, I will use a constant max of 7% for the scale. This gives the graph a much more realistic visual of the rates.

So where are those great rates?

CIT Bank (which we have featured before) has a 1y at 1.10% APY. Ally Bank has a 1.04% APY. In addition, we are working with a bank that has a 1.11% APY. After our special fee, you would net 1.06%. So if you are full at CIT and Ally, give us a call. The minimum amount that we can work with is $99,000.00.

If you find a good deal, let us know. Happy searching.

cd :O)

-- By Chris Duncan

Institutional rates have continued to fall back. I will have a post next week with an updated graph of the retail rates and I will begin tracking institutional as well. cd :O)

ChrisCD recently posted..The Power of Compounding Interest and Periodic Deposits